Banks are starting to realize more and more that a graph database fraud detection approach offers greater analysis effectiveness while not compromising performance or over-utilizing resources. Where RDBMS struggles is in accounting for the many relationships between customers and related entities because they must use complex SQL joins often requiring vast system resources.

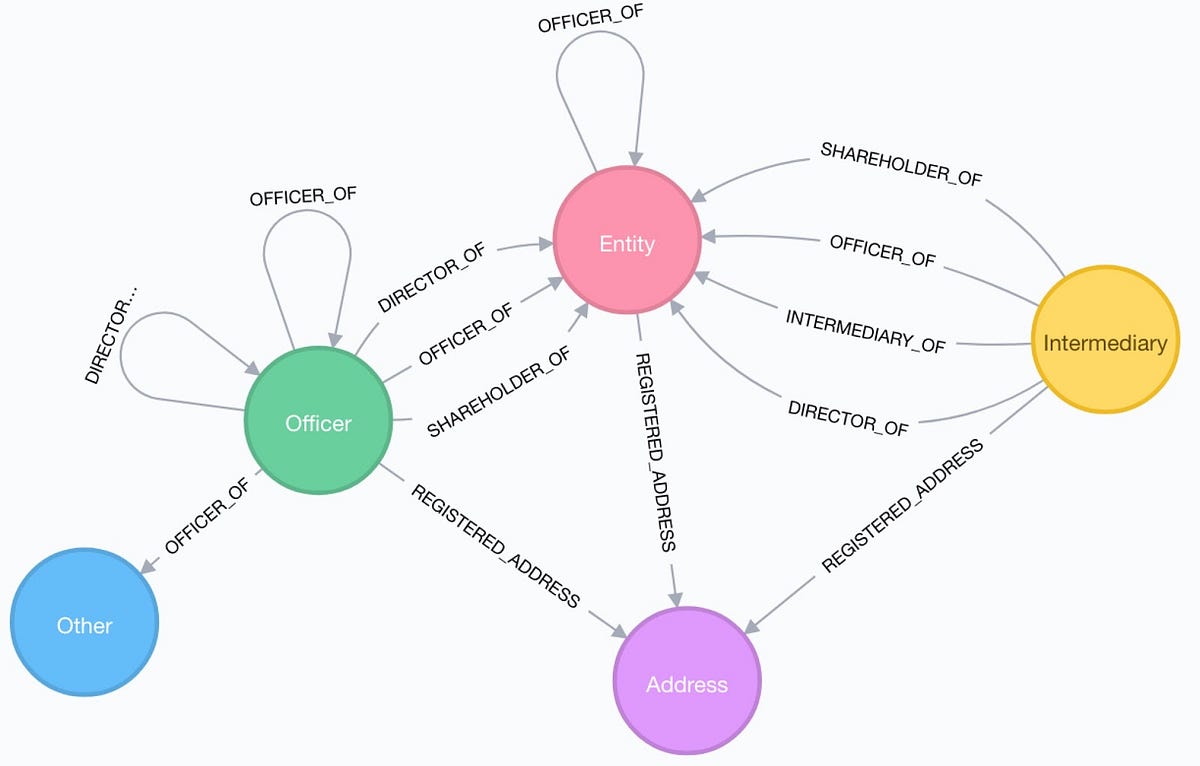

In this way, they are able to better facilitate the analysis of countless customer data points as well as the relationships and the nature of the relationships between those customers, at scale. While both RDBMS and graph databases may be able to perform similar functions when it comes to doing financial fraud analysis in fraud detection centers around the globe, uniquely, graph databases by nature capture the connectedness within the data. These suspicious patterns of fraudulent activity can be detected much more easily and effectively to help financial institutions to stop fraud in its tracks before critical financial damage can be done. However, with the advent of graph databases (for more, read “ What is a Graph Database?”), these banks are finding powerful new ways to combat such fraud schemes.ĭue to their very different architecture and approach, graph databases can help to identify suspicious patterns that were previously difficult or even impossible to detect with traditional relational database systems (RDBMS). With the rapid advancement of technology, criminals have been able to devise increasingly sophisticated fraud schemes to hide from the traditional detection systems of the big banks. The ICIJ found that leaked FinCen documents, “ …identify more than $2 trillion in transactions between 19 that were flagged by financial institutions’ internal compliance officers as possible money laundering or other criminal activity - including $514 billion at JPMorgan and $1.3 trillion at Deutsche Bank.” (ICIJ) Read on for details on how this technology is changing the game in a problem worth trillions of dollars to banks and other financial institutions. When it comes to detecting costly financial services fraud, there is simply nothing that can compare to graph database fraud detection (e.g.

0 kommentar(er)

0 kommentar(er)